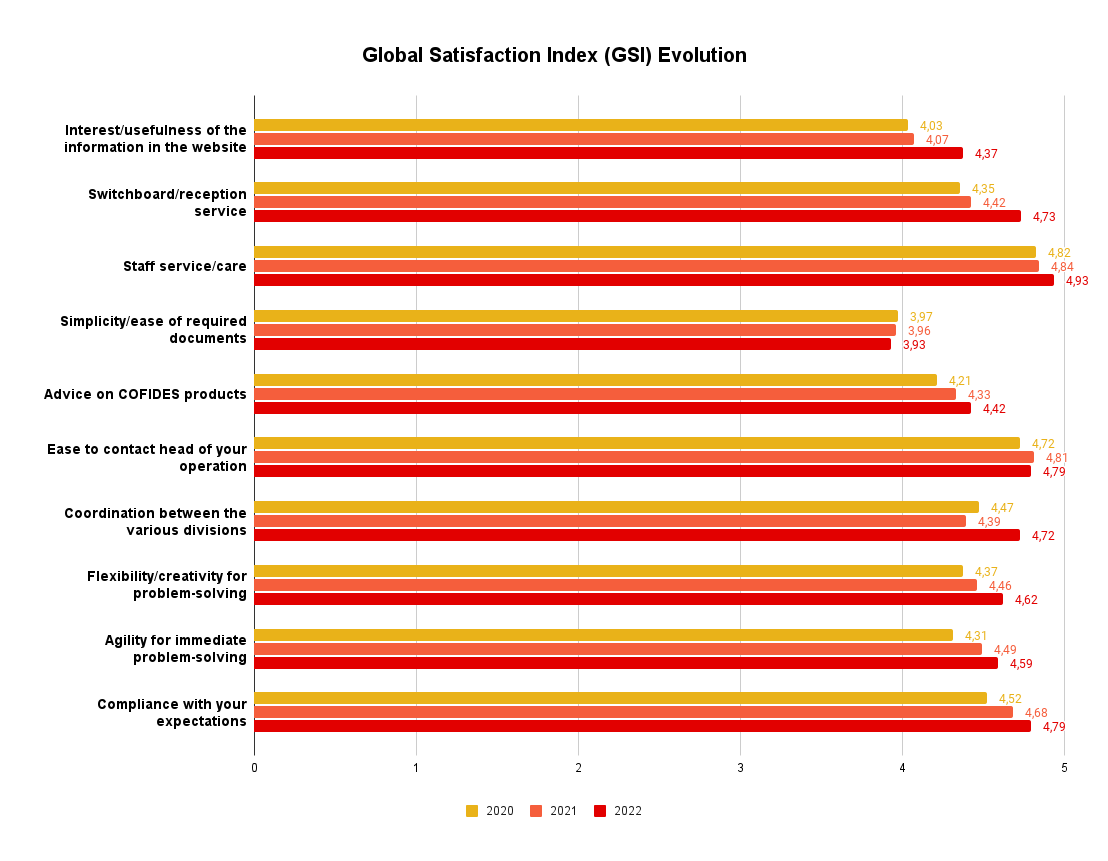

Madrid, May 09, 2023. The results of the annual satisfaction survey for 2022 evidence the service excellence of COFIDES in the provision of financial support for internationalisation. The global satisfaction index grew for the second year in a row, obtaining a value of 4.59 out 5. In turn, the client expectation compliance indicator reached a value of 4.79 out of 5.

The satisfaction survey scores on a scale from 1 to 5 (with 5 being the highest score and “excellent”), 10 essential elements of service provision.

Once again, clients have acknowledged the service and care received, the good coordination between the divisions and the ease to contact COFIDES staff. They also valued the agility in processing the financial support and the capability to offer flexible solutions for problem-solving, as well as the broad business expertise of their teams.

As in previous editions of this survey, simplification of the information requested was identified as a possible area for improvement, although clients understand this is closely related to the public and financial nature of the entity. Furthermore, there is a high level of awareness by clients of the need to request information on environmental and social aspects of projects for their optimal management.

The results evidence that COFIDES has been able to maintain the excellence of its service provision in a year that was particularly demanding for the Company, establishing a record level of activity, derived primarily from the implementation of the new mandate to manage the Recapitalisation Fund for Companies Affected by COVID-19 (FONREC).

ABOUT COFIDES

COFIDES is a state-owned company engaging in the management of State and third-party as well as its own funds, pursues a number of aims: internationalisation of Spain’s economy, furtherance of economic development and fortification of the solvency of companies affected by COVID-19. In addition to the Spanish State, its shareholders include Banco Santander, Banco Bilbao Vizcaya Argentaria (BBVA), Banco Sabadell and Development Bank of Latin America (CAF).